Gambling.com ($GAMB)

A serial acquirer trading at just 6.7x forward earnings

Name: Gambling.com Group Ltd ($GAMB)

Sector: Media (Gambling Focused)

Price: $6.90

Market Cap: $243m

P/E: 17

Forward P/E: 6.7

3-year revenue CAGR: ≈ 30%+

3-year earnings (or earnings per share) CAGR: ≈ 100%+

Thesis

Gambling.com ($GAMB) operates a high-margin, cash-generating affiliate and data business in a rapidly expanding market. Despite record fundamentals, the stock trades near all-time lows due to headwinds from search traffic and concerns about the rise of prediction markets. I believe the stock is trading at an attractive valuation here.

Background

Gambling.com was founded in 2006 by Charles Gillespie and Kevin McCrystle. The company started out as an affiliate marketer with a focus on Europe, where Gambling laws were more favorable. The company has never been a gambling operator, an important distinction to understand and remember. In the beginning, it took them a few years to figure out how to make affiliate marketing work through SEO. But by the early 2010s, they had a stable business model. In 2011, they acquired the domain Gambling.com at a significant discount relative to its value for just $2.5 million. The previous owners had repurchased the domain name in the mid-2000s, just before online gambling was made effectively illegal in the United States by the Unlawful Internet Gambling Enforcement Act of 2006 (UIGEA). After online gambling became illegal in the United States, the owners of Gambling.com at the time wanted to dispose of the asset and sold it at auction to $GAMB. When online sports betting began to be legalized in the United States in the late 2010s through the early 2020s, they were able to take the business model they’d been using in Europe and apply it in the United States. In practice, over 35 states have legalized some form of online or retail sports betting, and as a result, the business has seen fairly explosive growth over the last five years. The two remaining states that would be significant to the growth of their business are Texas and California if they were to legalize sports betting. There are some talks of some states concerning legalizing more versions of online gambling. If this were to occur, it’d be another tailwind to the business.

What does $GAMB do

$GAMB operates as an affiliate marketing company — it earns revenue by directing users to licensed online gambling operators. When a user visits one of $GAMB’s websites, signs up with a partner operator, and makes a deposit, $GAMB receives a commission or a share of the revenue generated from that player

Why does affiliate marketing work

Affiliate marketing works well in the gambling industry because of strict regulations around gambling ads — operators often can’t always advertise directly. Combined with the high customer lifetime value, this creates a strong incentive to acquire users organically. And since advertising is limited, bettors usually search for gambling sites on their own, making SEO especially powerful in this space. Their business is summarized below.

Google Search -> SEO to Gambling.com -> user signs up for some online casino product -> $GAMB makes money

For the last few years, they’ve been growing their business through a mix of acquisitions and organic growth. The large-scale legalization of sports betting has been particularly accretive to their business. What caught my eye about $GAMB, though, is that despite delivering their best-ever numbers, the business has traded down by more than 50% year to date.

Why the sell-off?

1. On Q2, the company cut $5M EBITDA from their guidance for the year. They noted they’ve been seeing lower traffic from Google, in part due to changes to AI and Google’s algorithm. Essentially, Google is giving people the answer they want via the AI summary cards at the top of search, so they don’t have to look further for websites. This is a headwind the business will continue to face going forward.

2. People are concerned about the rise of prediction markets and how that might affect $GAMB. If you make money by referring people to gambling sites, but they are using prediction markets instead, you can see how it could potentially be a threat to their business. This doesn’t concern me; it’s a tailwind for the industry in my opinion. The more people gamble, the more opportunities there are for everyone.

Despite the risks, one thing stood out during my review of the company’s financials: roughly half of $GAMB’s revenue base is recurring, derived from ongoing revenue-share agreements and data licensing contracts. This mix gives the business a meaningful buffer against quarter-to-quarter volatility. In other words, even if new customer acquisition slows, a large portion of earnings continues to flow. Let’s take a closer look at the structure of these recurring streams.

The Recurring Revenue

Half of their recurring revenue comes from their affiliate marketing business, and the other half from their data services business. As part of their earnout agreements for their affiliate marketing business, some companies opt for a revenue-sharing agreement rather than paying any up-front fees. Essentially, whatever revenue the said customer generates, a percentage of that is passed back to $GAMB. Given the high lifetime value of a customer, once a customer is on a platform that has opted into revenue-share agreements, it’s long-term accretive for $GAMB. This is where the first part of the recurring revenue comes from. The second part is from the data licensing business.

At the tail end of last year, $GAMB agreed to acquire Odds Holding. Odds Holding is a data service focused on the odds available for sports betting at any given moment. For example, if you want data on which lines are priced out at different sportsbooks, they have that information. They offer low-latency odds data and technology. For sports books and sports bettors, having this data in real time is critical. Here is why

Odds depend on many factors, such as injuries, weather, and historical performance.

If any of these things change, the odds change. If you’re a sportsbook company, and your odds do not update in real time along with the change in something such as a player’s health, your odds will be incorrect, and you will lose money. Conversely, on the sports betting side, for people who do this professionally, using these odds gives them an edge as they can front-run sportbooks before they update their odds.

Building a real-time system like this is very hard. Keeping it accurate and up to date is even harder. I know this firsthand as a software engineer — low-latency systems are some of the toughest to build and the least forgiving when something goes wrong. As a result, there is significant demand for this business, and it will likely grow. In terms of the prediction markets, the majority of their volume right now comes from sports. While prediction markets don’t actually take on risk through their odds structure, there’s still a significant incentive for folks trying to build a business around betting on sports professionally. I think this will increase demand for the existing data business.

The remaining 50% of their revenue comes from earnouts from non-recurring affiliate marketing in major markets. A lot of times, these gambling companies will pay $GAMB up front for a customer rather than a revenue-share agreement. This is the part of revenue that is variable and could be most affected by changes in their business going forward.

Full Revenue breakdown looks like

25% recurring affiliate marketing due to earnouts structured as revenue share agreements

25% through their data services business

50% variable affiliate marketing revenue is dependent on new depositing customers for the quarter

Margin for Error

Right now, $GAMB is trading at a forward earnings multiple of 7, which means that if the variable part of the business went to zero, they would still be trading at 14x earnings. If they return all cash to shareholders, that would be approximately a 7% return. Now, this is a modest return for a small-cap that would be in decline — I want to be really clear about that. That said, I think it’s doubtful that the core part of their business will disappear. Decline? sure. Disappear entirely? no. People will still use search, and SEO will still matter. I don’t know exactly how much it’ll decline, but even in a worst-case scenario, at 14x earnings, we’re not in a terrible spot. If they lose 50% of their non-recurring revenue, the business would still trade at 10x earnings. There’s significant breathing room, regardless of how their earnings progress over the next year. It’s worth noting that none of this accounts for any revenue growth in their data service businesses or additional acquisitions to offset decline.

Acquistions

• RotoWire (Roto Sports, Inc.) — December 2021 — ≈ $27.5 million

• BonusFinder (NDC Media) — January 2022 — ≈ $69 million (total potential, including earn-outs)

• Freebets.com (and related assets) — April 2024 — ≈ $37.5 – $42.5 million

• Odds Holdings (Parent of OddsJam) — January 2025 — ≈ $80 million upfront, up to $160 million total

• Spotlight.Vegas — September 2025 — ≈ $8 million at close, up to $30 million total

Besides affiliate marketing, $GAMB is also a serial acquirer, often acquiring businesses at 10-20x earnings (Odds Holding I estimate they paid 20x earnings for). Once they bring in the acquisition, they can use their expertise to grow the acquisition’s business further. They’ve been making 1 to 2 acquisitions a year since going public. These acquisitions will likely continue and are a core part of their growth since going public. Why?

Online Sports betting and prediction markets are both very young businesses in the United States. The vast majority of these markets have come to the public in just the last five years. As a result, a lot of the adjacent businesses are also relatively young, 5 years old (or less). If you’re a business or startup in this space and you’re looking to exit, who exactly is going to acquire you? There are only a handful of publicly traded affiliate marketing companies, and $GAMB is the only one listed in the United States. As a result, there’s a limited pool of potential buyers for businesses valued at $10–$100 million in the gambling space. Historically, GAMB has successfully grown and acquired properties (RotoWire, BonusFinder) through improved SEO and monetization, suggesting their roll-up model works.

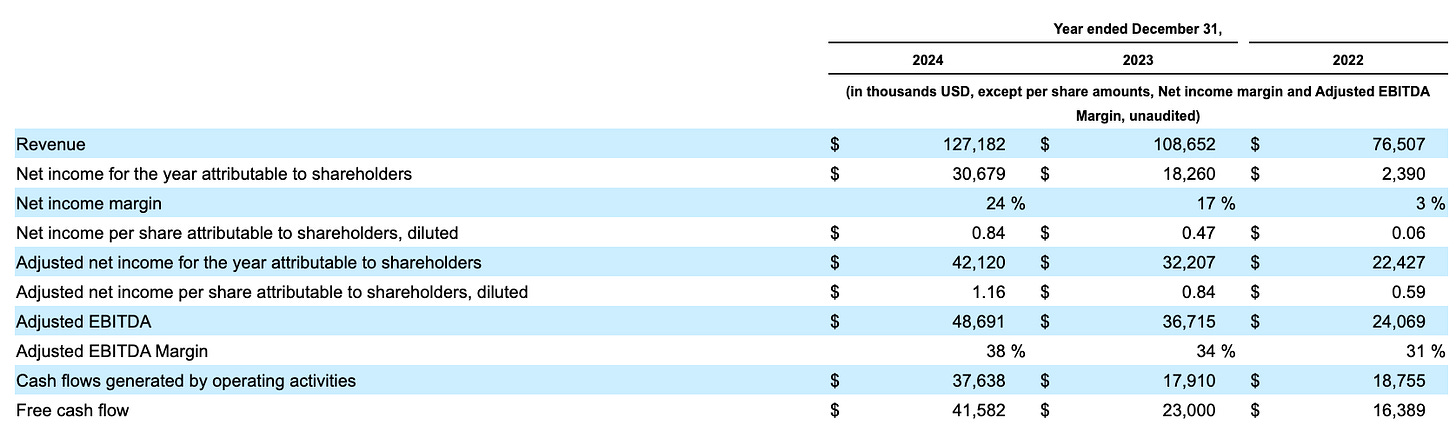

Revenue and Earnings as of 2024

Notice revenue has been growing nicely, and as they scale, their net income margin has grown nicely as well. For context, GAMB are on track to hit $175M of revenue this year and approximately $62M+ of adjusted EBITDA, both numbers up 30%+ YoY.

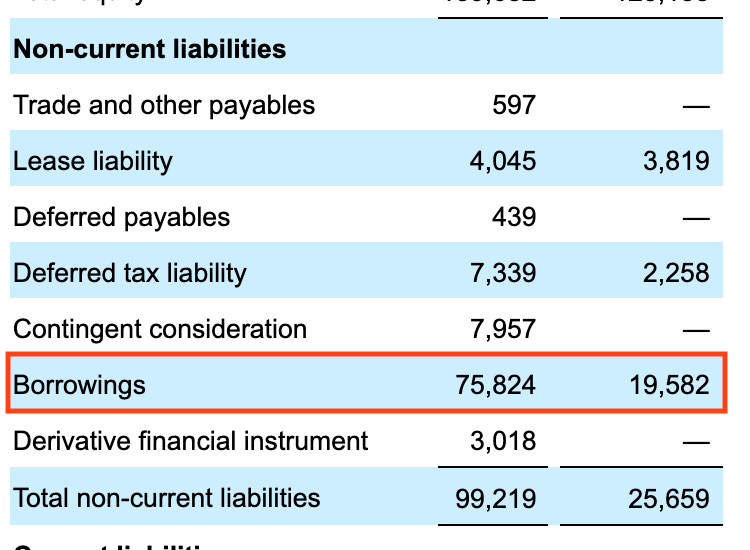

Balance Sheet

One thing I want to call out briefly is that they have $75M in debt from the acquisition of Odds Holdings. With their current free cash flow ($40m annually), they could pay this debt down in a couple of years comfortably. If the business were to materially decline, though, this debt could become a problem. It’s important to remember that debt is effectively borrowing from future earnings. When used correctly, it can be a powerful tool for building a business. When misused, it can be a pretty significant drag on the long-term stock value and, notably, cash flows.

Glassdoor

I don’t use Glassdoor as a hard signal, but I am always happy to see high CEO approval among employees and a high Glassdoor rating. A higher rating and high approval score are usually indicative of a well-run company. Generally, happier employees do better work.

Conclusion

Every core KPI is up and to the right over the last three years since GAMB went public. Interestingly, $GAMB has its best fundamentals ever while trading near its all-time lows. I expect the next 12–18 months to be key as the company integrates Odds Holdings and proves the stability of its recurring revenue.

I am long 2,000 shares here at $7.36. With expectations rock bottom, if $GAMB delivers decent earnings, we’ll likely see 30%+ appreciation in the short term. If $GAMB can deliver growth over the next year through more acquisitions or by expanding its data services business, I wouldn’t be surprised to see the company reach $15+. Ultimately, I believe this is an EV-positive bet and am willing to take a shot here.