Nubank

A Superapp in the making

This is not investment advice

Position is below

Introduction

I first started investing in Nubank back in May of this year. With the recent pullback I thought it would be a good time to revisit my thesis and share why I am long Nubank. At the highest point I was up 100% on my calls and 30% on my equity position. As of today I am now down on this position but will continue to hold regardless of how the stock moves.

Nubank

Nubank is a digital financial technology company that was founded in Brazil in 2013 by David Vélez, Cristina Junqueira, and Edward Wible. At the time it was founded on the novel idea of a purely digital bank in an emerging market. Traditionally banks in the Brazilian market had only catered to higher income individuals. It was common practice to have to pay to have a checking account and a savings account. There was no such thing as “no fee” credit cards. The primary reason for these lackluster business models is quite simply a lack of competition. This is common throughout all of LATAM and has left 100s of millions unbanked and without access to proper financial services. Due to the delay in development of LATAM it’s not entirely uncommon for them to skip entire aspects of the development cycle. Meaning many folks have never banked at a traditional bank prior to going fully digital. I think Nubank’s potential is best understood through their numbers. And more importantly I believe Nubank will become a superapp in LATAM. To start though, I believe it’s best to understand some of their basic numbers.

The Numbers

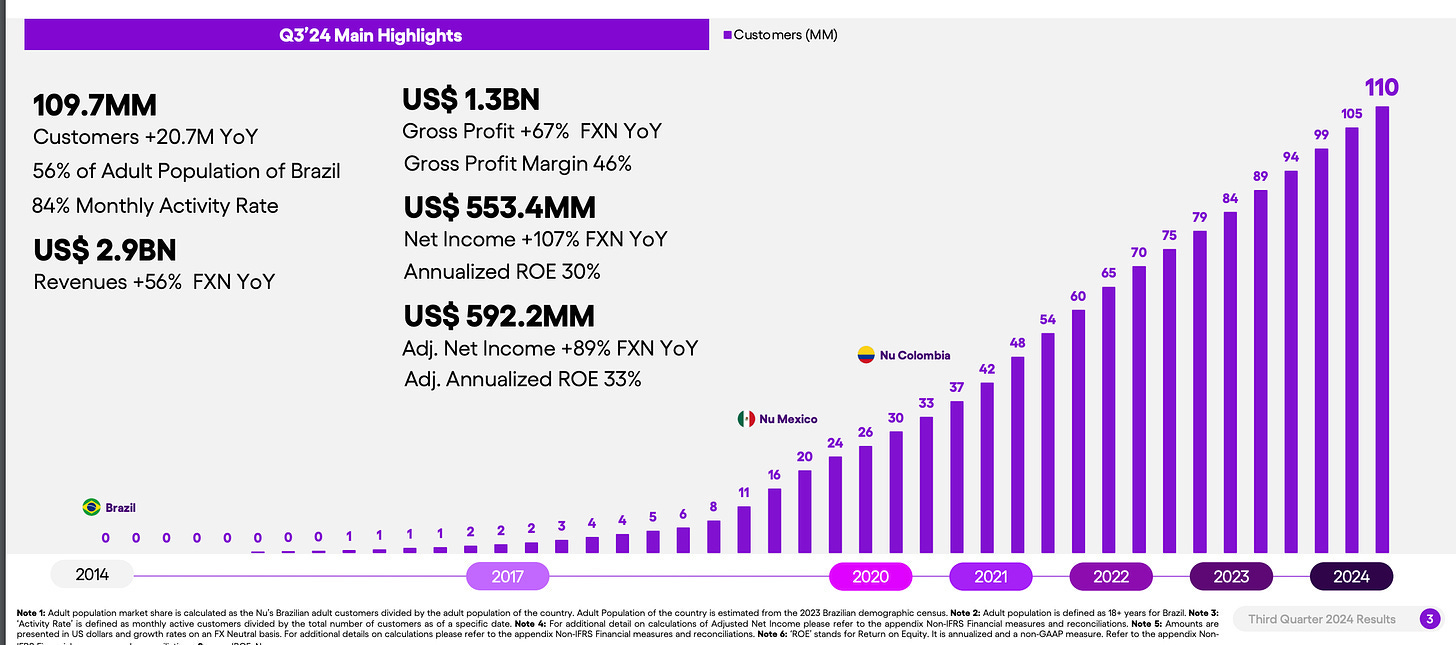

Customer Growth Over Time

Nubank is currently at 110 million customers and is adding 5 million new customers a quarter. Of these 110 million customers 80% are active at least once a month. 60% of their customers use Nubank as their primary bank account. Currently the cost to acquire each customer averages just $20. The average revenue per active customer (ARPAC) is $11 and the average cost to the bank is $0.90 per month per customer. I estimate the payback period per customer is about 6 months. Given the lifetime of a banking customer these are truly exceptional unit economics. It’s also worth noting 80% of Nubank users have been customers for less than 5 years. I’d fully expect as users go through their lives the amount they earn and the numbers of products at Nu they use will both increase and thus increase a users revenue contribution. Additionally I fully expect even mature cohorts to have a long runway for increasing their revenue contribution as more products are added. To understand a user's contribution it’s best to understand how the ARPAC of users works.

Average Revenue by Cohort

The ramp up ARPAC is highlighted by this graphic. We can see the most mature cohorts from 2017 are already at $24 a month, double that of the current active customer. It’s important to note that user growth is a headwind for this metric as new users generate less revenue and thus actually decrease ARPAC. So essentially user expansion into both Mexico and Colombia are headwinds to ARPAC because the size of their product offering is less and the users are newer so they have adopted less products. . We can see here many of the newer cohorts are generating half the revenue of the more mature cohorts. Revenue per user grows overtime and it takes years for a customer to reach their full potential in terms of revenue contribution. As we saw above the aggressive user growth means many users are early in their life cycle in their revenue contribution. I believe to understand this further you need to see total revenue contribution by grouped cohorts.

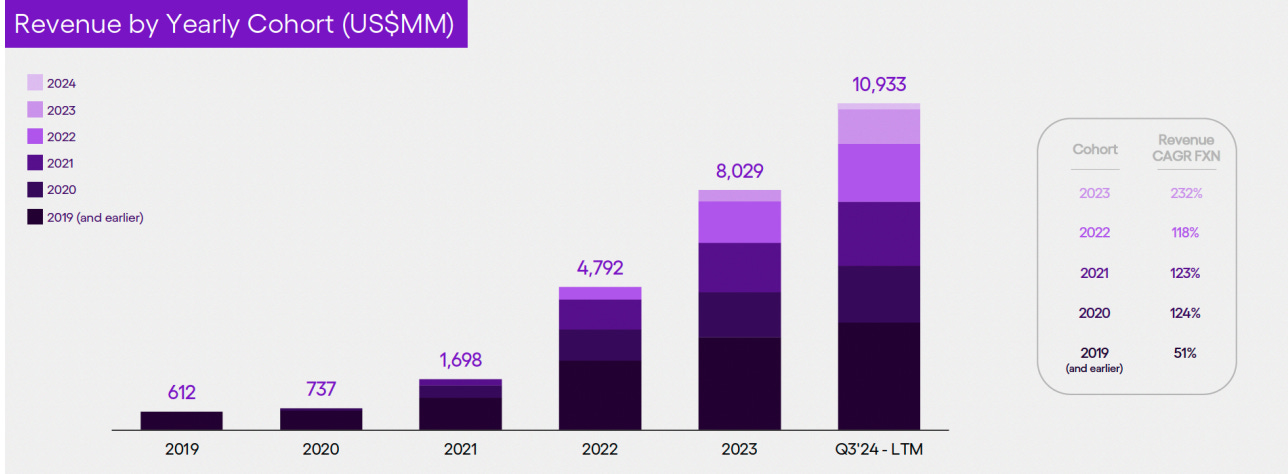

Revenue contribution by cohort

From this graph we can see that the 2019 cohorts represent approximately 20% of all users but about 30-35% all of revenue. While conversely the 2023 and 2024 cohorts represent 40% of all users but just 15% of all revenues. As of now a smaller percentage of the user base is driving much of the revenue and profits. As the newer user base matures overtime we will continue to see tailwinds for revenue growth as their earnings power increases and product usage increases. I also believe newer cohorts have a higher ceiling in terms of revenue generation as the newer cohorts are likely younger and therefore more likely to use Nubank for as many of their needs as possible. Someone who already has insurance for instance is less incentivized to use the Nubank offering. But a younger user is more likely to have a wide array of needs that are yet met and therefore more likely to just use Nu for these services. Additionally as the product base Nu offers increases, we will also see these products integrate with each other. If a user is using banking, credit, insurance and cellphone Nu can offer better pricing and recommend products that make sense for each user. This leads to what I believe Nu’s largest and yet unrealized opportunity is: building a superapp.

Superapp Thesis

I personally believe the strongest argument for Nubank’s future success lies in the size of their customer base. 110 million users is a lot of users to monetize. When I look at LATAM as it is currently, it’s obvious to me there are many more opportunities for Nubank to pursue. Nu was actually originally founded trying to solve one of the largest pain points which is the business of banking. An old and outdated legacy system designed to only benefit the wealthy and this has been their focus of the last 10 years. When a business is in their early days they have limited capital and therefore often can only focus on solving one problem at a time. As Nubank has hit profitability in the last year it positions them well to start exploring more business opportunities. I find this comment from David Velez in their Q3 2024 earnings call indicative of the future of Nu.

There is a huge amount of synergies around the consumer base that we have. We are getting close to 60% of the Brazilian adult population, over 100 million Brazilian customers. So we have to spend very little money on customer acquisition and marketing. There is a huge amount of synergies on serving customers efficiently. We know how to do that for different sub-segments. For us specifically, there is a lot of value in creating a digital ecosystem. This is something we've been speaking about for several quarters now where we think that there is a big opportunity to go beyond financial services in new verticals.

Despite the company being 10 years old, it is very early days for the potential of this company. When you go back and look at many of the most successful businesses they all go through a very similar path. Early on they focused on one path to profitability and as they hit profitability in that line of business they start to expand into new lines of business. Amazon started with books, then general retail, then web services, pharmacy, streaming, etc. you get the point. Nubank has found success in banking so as of today they are still “just a bank.” But I believe they will find lines of profitability across many businesses. Just in November Nu announced their move into telecom offerings in Brazil, another pain point in terms of products in the Brazilian market. It won’t surprise me at all to see them continue to offer more and more products through their app. In terms of competition, the reason other companies don’t pursue these businesses is because many of them don’t have either the capital or technical know- how. While both of these are commonplace in the United States, it’s much rarer outside of the US and especially in LATAM. There isn’t the same VC and funding structure, there isn’t the same drive towards easy to use and simple experiences and there are not many large and successful tech companies (yet) in this demographic. As a result the ceiling of what NU can pursue and achieve is much higher than people realize due to lower competition and large user pain points. Because of this in emerging economies I believe there is more opportunity for a company like Nu to monopolize multiple industries instead of just one. We rarely see this in the United States because it is very competitive. This puts Nu in a very unique position to build a product for their users across multiple lines of business and across multiple countries. Nu have already started to pursue this and they now have their eyes set on Mexico.

Nubank Billboard I saw in Mexico City

Mexico

While Nubank is also in Colombia, Mexico is their largest opportunity outside of Brazil currently. The GDP per capita is larger in Mexico ($11,477 to Brazil's $8,917) and the size of the unbanked market is approximately 50% of the country (60 million people). This is a huge opportunity for Nubank to essentially double their potential revenue. As someone who has lived in Mexico a fair amount, I can tell you that you always need cash in Mexico as many vendors do not take credit cards. While there I asked my fiance’s friends (all are Mexican) if they have Nubank cards and they all did. It’s obviously anecdotal but it’s clear to me there is demand and desire for Nu’s products in Mexico. Nu is starting to see an acceleration of new users in the country with 1 million added last quarter. With increased profitability Nubank can spend more on advertising and focus on growing their customer base before they eventually move to focus on profitability. Nu tends to ramp up slowly and verify business economics. The first 5 years of Nubank in Brazil they didn’t offer a savings account for instance. With Mexico I believe it will follow a similar path as Brazil and we will see the ramp continue to tick up overtime. It’s still early days for this international expansion but present a similar opportunity for success as they have found in Brazil.

Argentina

I want to touch on Argentina briefly here. Under Javier Melei it’s quite possible Argentina will finally move on from decades of bad economic policy towards a more prosperous and financially stable country long term. David Velez has mentioned they are watching and keeping an eye on Argentina to see how it develops. In a few years time we could see Nubank moving into Argentina and if so that would provide another sizable opportunity.

Other Countries

Lastly I’ve seen multiple interviews with David Velez where he mentions going beyond LATAM. It’s not something I am betting the bank on, but I do believe there are many other economies outside of LATAM where customers do not have access to quality financial services. Building a bank in LATAM is extremely challenging which puts Nubank in an interesting position as one of the few companies who know how to succeed in developing economies. It will be interesting to see how Nubank opts to grow in the coming years.

Risks

At a high level all companies face these risks but companies outside of the United States are especially more prone to these risks. I want to touch on them briefly as they are important to understand the primary reason foreign businesses almost always trade at a discount relative to the US market.

Economic Risks - Brazil is heavily commodity dependent and is thus much more susceptible to swings in the economic cycle. Brazil actually was in a recession for a good part of the 2010s even when the rest of the world had mostly moved past the great recession of the late 2000s. A diversified economy like the US is of course still prone to recessions but one sector weakness can be easily offset by another sector. With Brazil their focus on commodities exposes them to a more cyclical economy and thus potentially more cyclical earnings.

Government and Geopolitical - A bad leader can have significant adverse effects on investments. For example a leader that controls the central bank can easily cause runaway inflation by not managing interest rates properly, this is currently happening in Turkey. Or imagine you owned an investment in Ukraine prior to the start of the war with Russia. These are real risks when investing outside of the United States. Politics are complicated and messy. Brazil and the risks their politics play is no different and something to be aware of.

Currency risk - If you are a US based investor investing with the US dollar, then any weakening of a foreign currency (in the case the BRL) relative to the US dollar is a headwind to your investment. If Nu were to pay out a dividend in BRL but the BRL weakens to the USD then you would receive less despite no changes in the underlying business. Additionally if a country like Brazil were to have run away inflation it could easily destroy the value of your investment overnight. One of these reasons Brazilian businesses listed on the US Stock exchanges have muted price action is due to weakening of the BRL to USD this year. I personally believe of all risks, this one is the most significant. A 10% growth in the business and a 10% weakening in the BRL yields FXN growth of 0%.

Nubank Glassdoor rating

Conclusion - Superapp in summary

Continue user growth in Brazil, Mexico and Colombia, eventually achieve 250 million users. Potentially grow to other countries long term.

Continue to add more product offerings and increase ARPAC. Build a superapp with the best user experience in the LATAM market

Diversify revenue between countries and product offerings, protecting from downside and maximizing upside.

I believe Nubank has the potential to 10x its business over the next decade if it achieves its goals. I remain confident in the company’s profitability, user growth, and expanding product offerings. I plan to hold my position and see how the superapp thesis plays out and will revisit Nu in a year's time.

Sources

ttps://api.mziq.com/mzfilemanager/v2/d/59a081d2-0d63-4bb5-b786-4c07ae26bc74/066081b7-71a9-87bc-2ff6-bb4b0ec7a3b8?origin=1

https://api.mziq.com/mzfilemanager/v2/d/59a081d2-0d63-4bb5-b786-4c07ae26bc74/42a0273a-49c5-c806-ef66-d093566fa27d?origin=1

Why did you sell