Reddit ($RDDT): Trailing Metrics Are Lying to You

A story of growth, margins and AI

Note:

All numbers referred to in this article are GAAP because I don’t see the point of imaginary numbers

This article is lower quality than normal (sorry), but I wanted to put this out ASAP b/c Reddit has a tendency to move quickly.

META is Reddit’s closest comparable and represents what Reddit will look like at maturity. As a result, I reference Meta a lot throughout the article. Also, Meta is cheap here.

Not financial advice

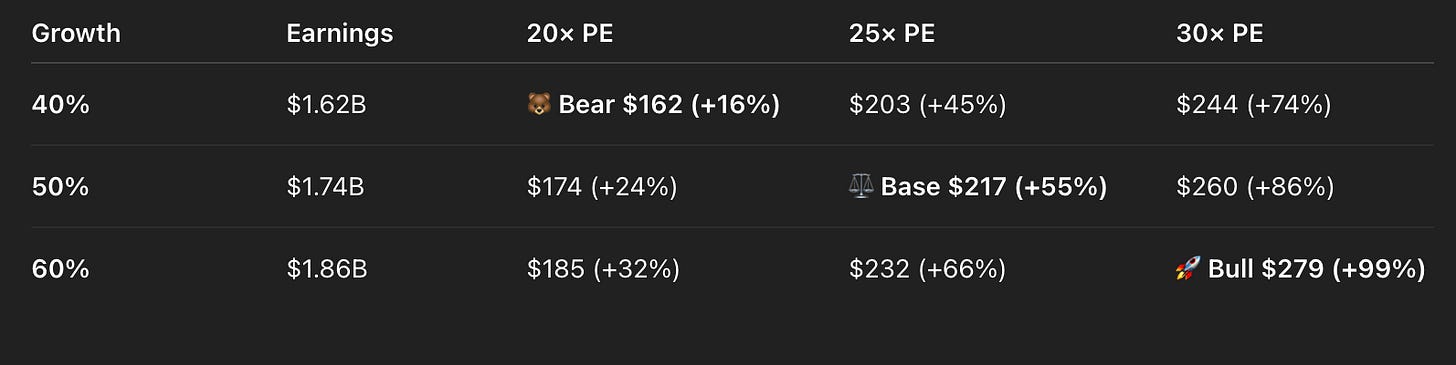

TLDR: Reddit trades at 26x earnings and will grow 50% this year. I believe that at the current price of $140, the stock has 50% implied upside. My price target is $210 by EOY.

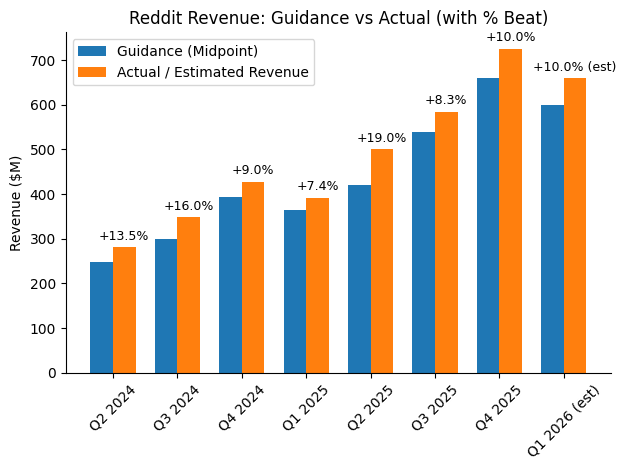

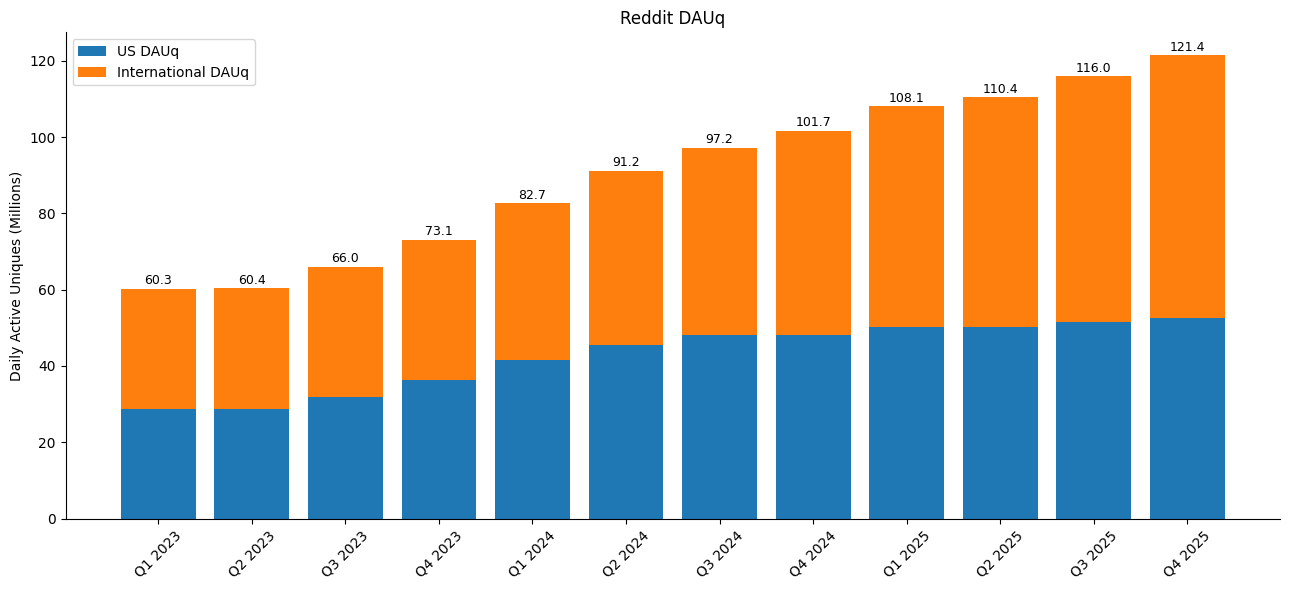

You know you’re in a difficult market when a company posts 70% year-over-year growth, and the company sells off anyway. Not only did they beat their own guidance, but they beat the street’s expectations across the board. Still, there are concerns about their growth in logged-in daily active users, which increased by only 10% year over year.

While these metrics are important, given that Reddit is a business, improving financial performance significantly outweighs a core KPI such as DAU. What’s painfully clear is that the market still doesn’t understand how to value the business or appreciate how cheap the company is. This disconnect largely results from the use of trailing 12-month metrics. For most businesses, these are meaningful metrics, but in the case of Reddit, they wildly undersell the current state of the business.

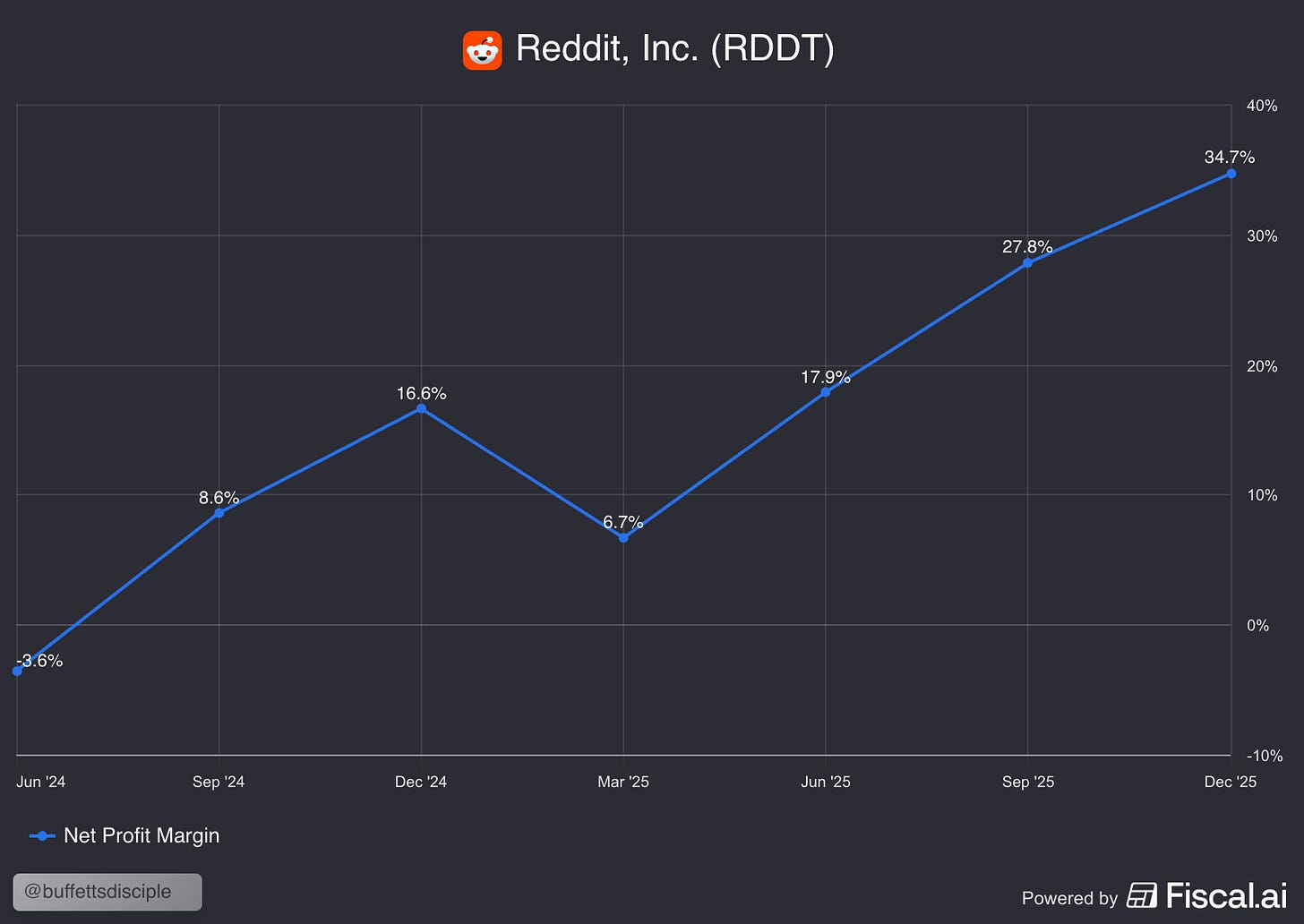

Reddit increased its net margin from 16.6% to 34.7% over the past year. If you use trailing 12-month metrics, you are using metrics that no longer represent the true earnings power of the business. To gain the best sense of Reddit, you need to calculate the earnings metrics yourself.

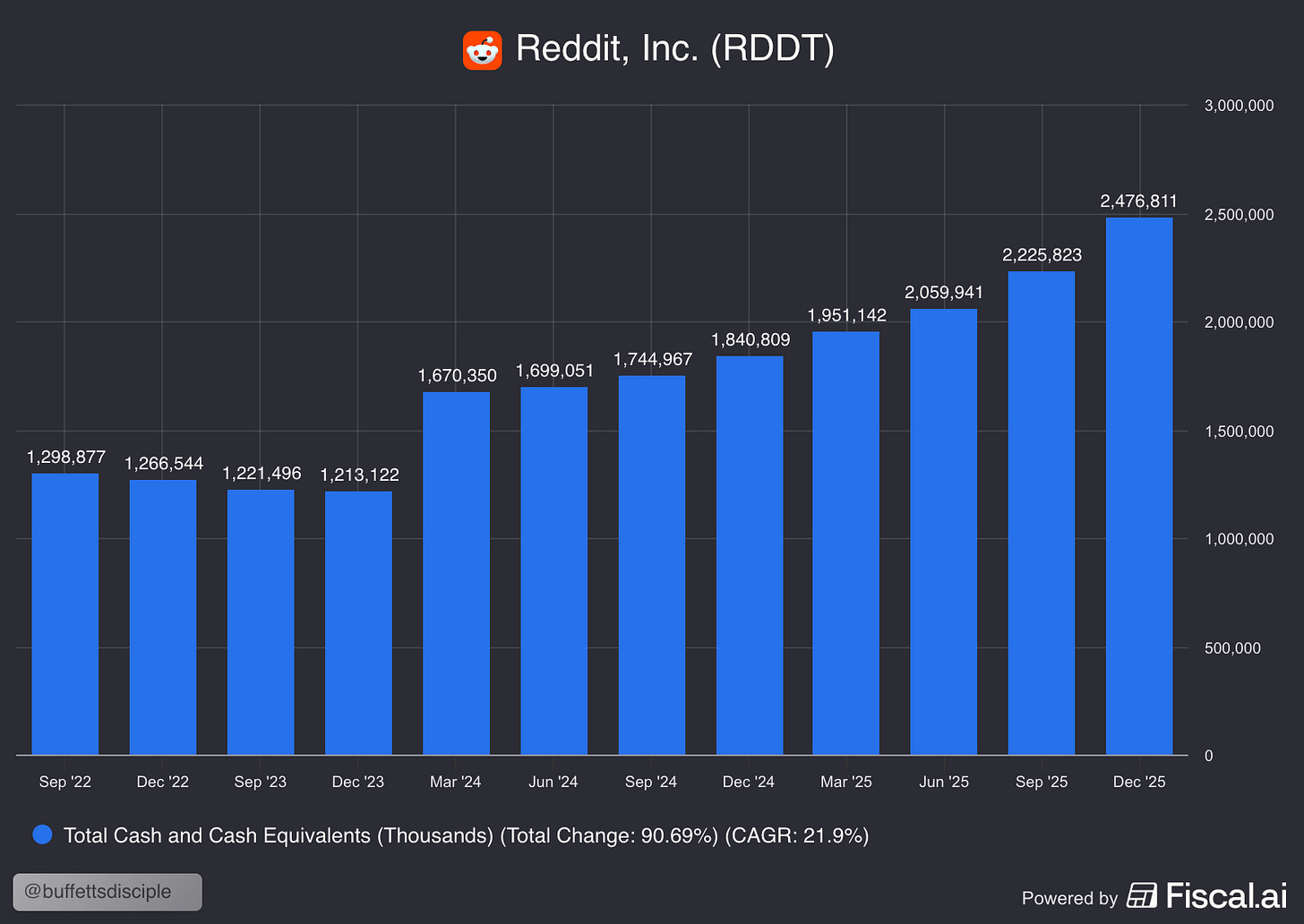

For example, Q4 earnings were $252 million. On an annualized basis, that’s $1,008 million. The company has a market capitalization of $28 billion and $2 billion in cash and equivalents on its balance sheet. If we use enterprise value and divide it by annualized earnings, we get 26x earnings. The Reddit thesis is incredibly simple: Reddit’s margins will normalize at 45% annually, and the business will continue to grow aggressively on the back of increased user growth, higher usage, and as a massive beneficiary of AI. When the market recognizes Reddit’s true margins and gains confidence in the business’s long-term growth trajectory, it will re-rate alongside massive growth.

Reddit is 50% undervalued today.

What is Reddit?

Reddit is a popular online forum founded in 2005 by Steve Huffman and Alexis Ohanian. They were a part of the inaugural batch of Y Combinator. The original purpose of the website was to share popular links and allow users to vote on interesting content. But it quickly evolved into a network of thousands of niche topic-based communities known as subreddits. After launch, the product quickly gained traction, and the young founders poured themselves into running the website and keeping everything online.

In 2006, over a year after launch, Reddit received an acquisition offer from Condé Nast, a well-known publisher at the time. Although Reddit was gaining significant traction, the company had only $75,000 in the bank and no clear path to generating revenue or profitability. The offer was $10m, and given their uncertain future, it was too much to pass up. The founders agreed to sell the company to Condé Nast. Both co-founders, Steve Huffman and Alexis Ohanian, would leave Reddit within a few years of the acquisition and pursue new ventures.

While Reddit continued to gain traction, it still faced a critical issue: it could not generate meaningful advertising revenue. What exactly was the point of Condé Nast owning a product that simply burned money? The small team at Reddit, concerned about the future of the business, decided to take a risk. They launched Reddit Gold, a premium subscription service that offered nothing more than the team’s guarantee to Reddit’s users that it would continue to ship features. Reddit Gold gained sufficient traction to generate more revenue from this subscription service than from advertising. This gave Reddit a potential lifeline for its long-term future.

Even with improved financials, Condé Nast didn’t feel that the revenue generated by Reddit was enough, so they spun the company out into its own start-up to run on its own two feet. The business struggled from 2012 to 2015, largely due to significant content issues and modest monetization. Since Reddit was originally founded as a community run by moderators, the team at the time did not feel it had the authority to enforce content rules. Users exploited the system to post large volumes of legal but malicious content.

In 2015, the company reached a breaking point, and Steve Huffman was brought back to serve as CEO. Steve Huffman implemented a stricter content policy and began banning notorious subreddits, including r/watchpeopledie, r/holdmyfries, and r/imgoingtohellforthis. The bans were well received by the broader Reddit community, which disliked the toxicity of these subreddits. Steve Huffman also moved quickly to reorient Reddit on a long-term, sustainable path. It took time, but by 2022, Reddit had begun to gain traction in its advertising business, nearly 10 years after his return. It was enough to open up a clear pathway to an IPO.

In early 2024, Reddit was successfully listed on the New York Stock Exchange under the ticker symbol RDDT and raised approximately $700 million1. Because Reddit had never turned a profit, there was initial skepticism over the company despite its strong growth. A business that has been around for 20 years and is not yet profitable is a significant concern. However, circumstances changed when the business became profitable in Q3 2024, and it became clear that the company had a long-term, sustainable future.

Due to recent profitability, their margins have not yet stabilized, and their profitability is underrepresented. To best understand this, let’s explore the margin story further.

Margins

Reddit’s margins have expanded from 16.6% to 34.7% in the last 12 months, a 100% increase YoY. When using the trailing 12-month P/E, you’re including margins as low as 6.7%, which are no longer reflective of the business. This is why it’s critically important to always annualize Reddit’s numbers.

Reddit’s gross margin is 91%, while Meta’s is 80%, which implies Reddit’s net income margin at scale will be higher than Meta’s. The question now is the following: What is the upper limit on Reddit’s net margin? I’d argue 45% margins are highly probable, with a chance of achieving 50% net margins over the next 5 years. Not only does Reddit have higher gross margins than Meta, but its younger business will also allow it to leverage AI efficiencies to the fullest. We’re at the beginning of a period where businesses will be larger with a lower headcount, and Reddit will be one of the clear winners.

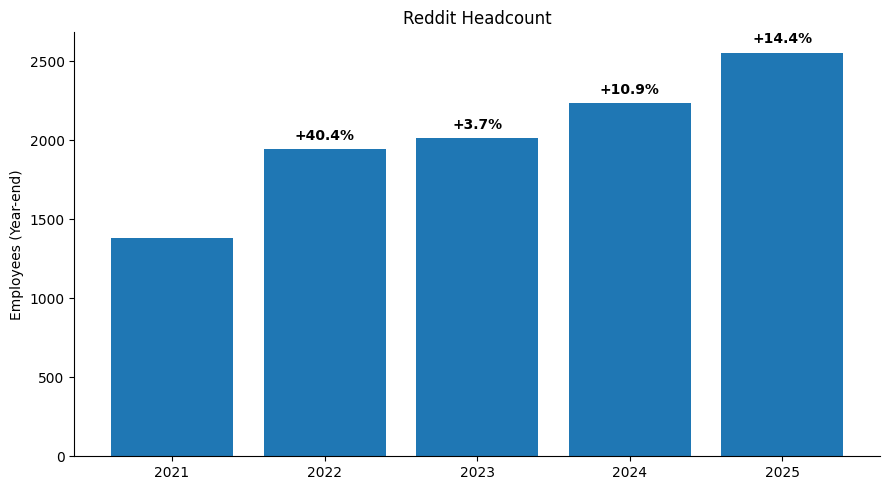

In 2025, their headcount increased by only 14% despite a 70% increase in revenue. Historically, when businesses grew at this rate, they reinvested aggressively. Fortunately for Reddit, the company didn’t take off until around the time that the AI revolution started. The prudent choice is to cautiously expand headcount and leverage AI to its full potential. As bullish as I am on their margin story. I do want to cover a couple of tailwinds that will disappear in the next couple of years in terms of margin.

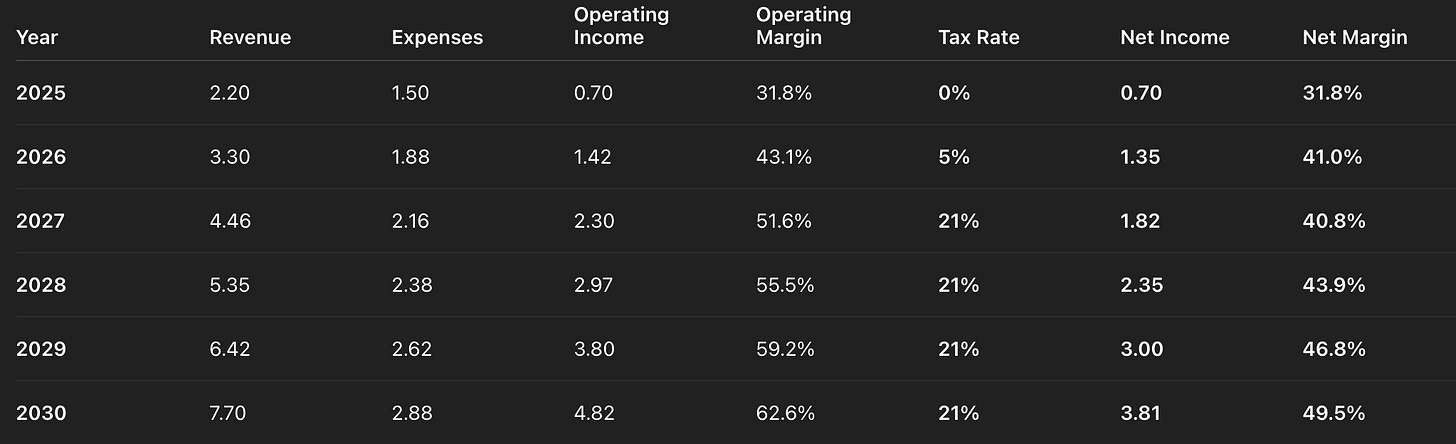

First, Reddit has substantial cash on its balance sheet; the interest on this cash modestly increases its margin by an average of 2% per quarter. Second, they are effectively paying no taxes at present, as they have net Operating Losses (NOLs) that they are carrying forward. They currently have $1.7B in federal NOLs and $800M in state NOLs. The state NOLs begin to expire this year; as a result, they will have a higher tax burden as 2026 plays out. As for the federal NOLs, these don’t expire, and they’ll effectively have to recognize roughly $1.7B in income before they exhaust them entirely. These NOLs will likely be recognized by the end of 2027, thereby normalizing their tax expenses by 2028. Below is my projection of how their net margin will roughly grow over the next five years

This table assumes 2025 revenue of $2.2B growing 50% in 2026, 35% in 2027, and 20% thereafter, expenses starting at $1.5B growing 25%, 15%, then 10% annually, with NOL-shielded taxes of 0% in 2025, 5% in 2026, and a normalized 21% rate thereafter.

Also note that these are annualized figures. Over the long term, these numbers will normalize. Over the short term, they’ll be a bit bumpier. By 2027, I expect the lumpiness to be smoothed out.

While these growth numbers might seem aggressive, it’s important to note how much of a tailwind AI is to both social media and advertising businesses. META, a business that you would think would be decelerating by now, is projecting 30% growth in Q1. As long as Reddit is competent, it’ll continue to benefit from the same tailwinds as Meta.

Social Media Businesses Are the Biggest Winners of AI

As things stand, there is no better business position in the entire market than the social media business. Social media businesses are unique in that AI is applicable across all aspects of their operations. Here are the two key aspects to know:

The actual content itself

The advertising experience

A significant part of any social media company, including Reddit, is displaying appropriate content to the appropriate users at the appropriate time. This is a classic machine learning problem and something that Reddit has been doing for years. AI only improves the quality of these algorithms. Reddit displays more ads to users the longer they remain on the platform. Continuing to increase user engagement is a core strategy for increasing revenue.

It’s also useful for improving content quality. While it’s true that Reddit risks being flooded with low-quality AI-generated content, users typically do an adequate job of filtering out such content via the upvote and downvote systems. AI enables users to produce not only more content but also higher-quality content, which will continue to yield long-term engagement outcomes. In addition, there are many creative ways Reddit can use AI to interact with the website itself. I’m excited to see how the product progresses over the next five years. Next, perhaps the greatest beneficiary is the advertising part of the business itself.

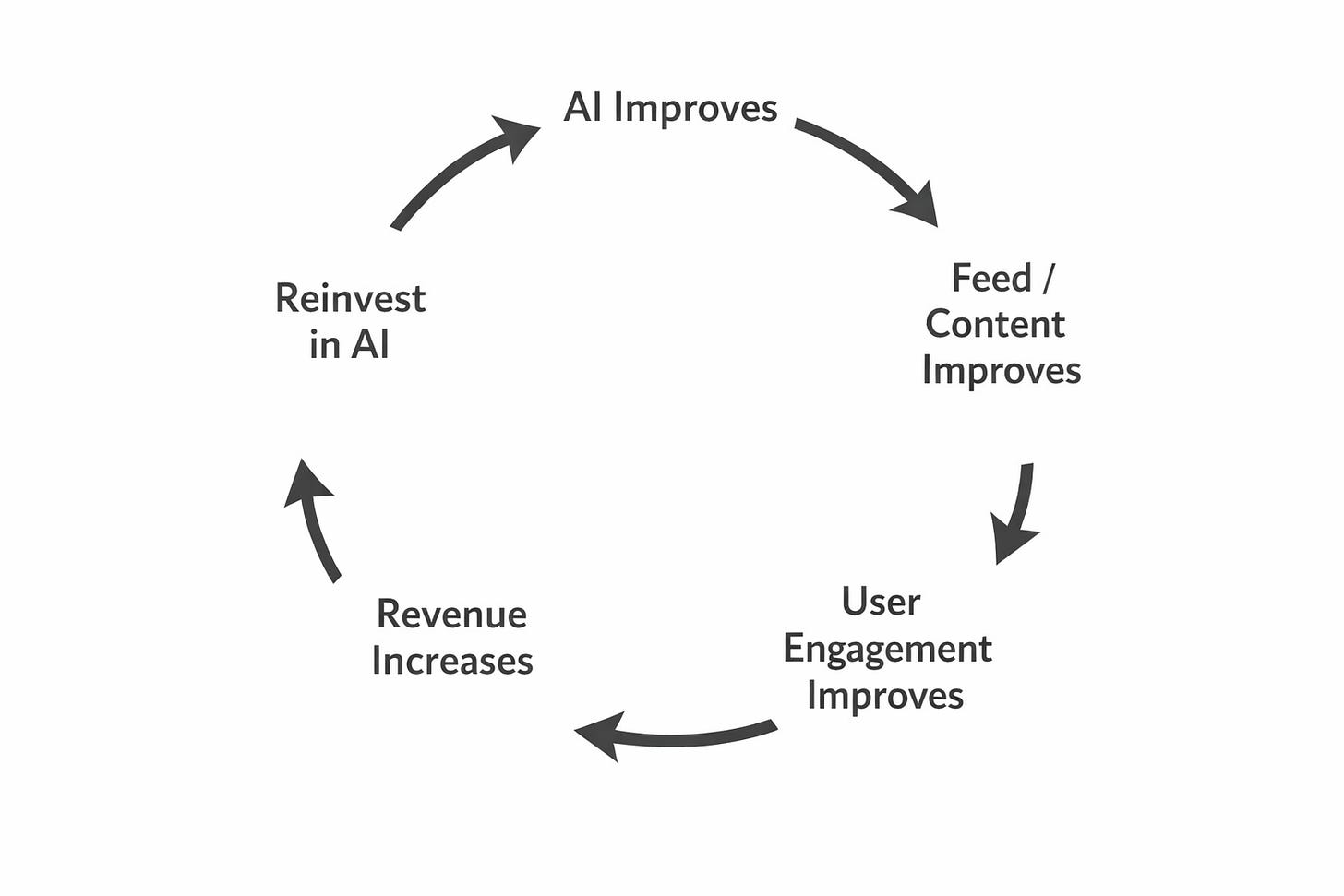

META’s growth has re-accelerated as AI improves its core algorithms. Aggressive AI improvements are also why Reddit has been posting these exceptional numbers. As AI improves, their advertising improves, increasing revenue and allowing them to reinvest in the business. At this point, it’s become a self-perpetuating cycle, and given how early we are in AI, this aspect of the business will continue to see significant improvements over the next five years. As AI improves, Reddit makes more money.

AI is also a significant benefit to advertisers. Consider a small business and how historically expensive and time-consuming it has been to prepare an advertisement. As AI improves, the barrier to creating effective advertising is rapidly eroding. Even an everyday peasant such as myself could put together a reasonable advertisement for any product. Competent companies such as Reddit will ideally integrate this into their advertising funnel, enabling small businesses to quickly generate Ads and run A/B tests.

The most effective way to increase advertising revenue is to deliver meaningful results to advertisers.

Which brings me to my final point. Reddit benefits massively in terms of productivity per employee. Tech-focused companies like Reddit will be the first to leverage AI to its fullest extent, minimizing cost growth as the business grows.

Headcount and AI

In the 2010s, META’s headcount grew at an average annual rate of 40%2. However, in recent years, their headcount has been growing at single-digit percentages. Why? It’s because they’re leveraging AI. Which means revenues will continue to grow faster than headcount. For tech companies, the single greatest expense is always employee compensation ($200k+ per engineer easily). If this were 10 years ago, Reddit, too, would be growing its employee headcount 30-40% annually. Reddit’s headcount, however, has been growing at a much more modest pace, at a marginal 15% over the last year, despite revenue growing by 70%. If Reddit can maintain this trajectory, its operating margin will continue to expand. AI is enabling a new class of businesses that can grow aggressively while maintaining lower costs. While net margins as high as 50% were previously unheard of, it’s possible for Reddit.

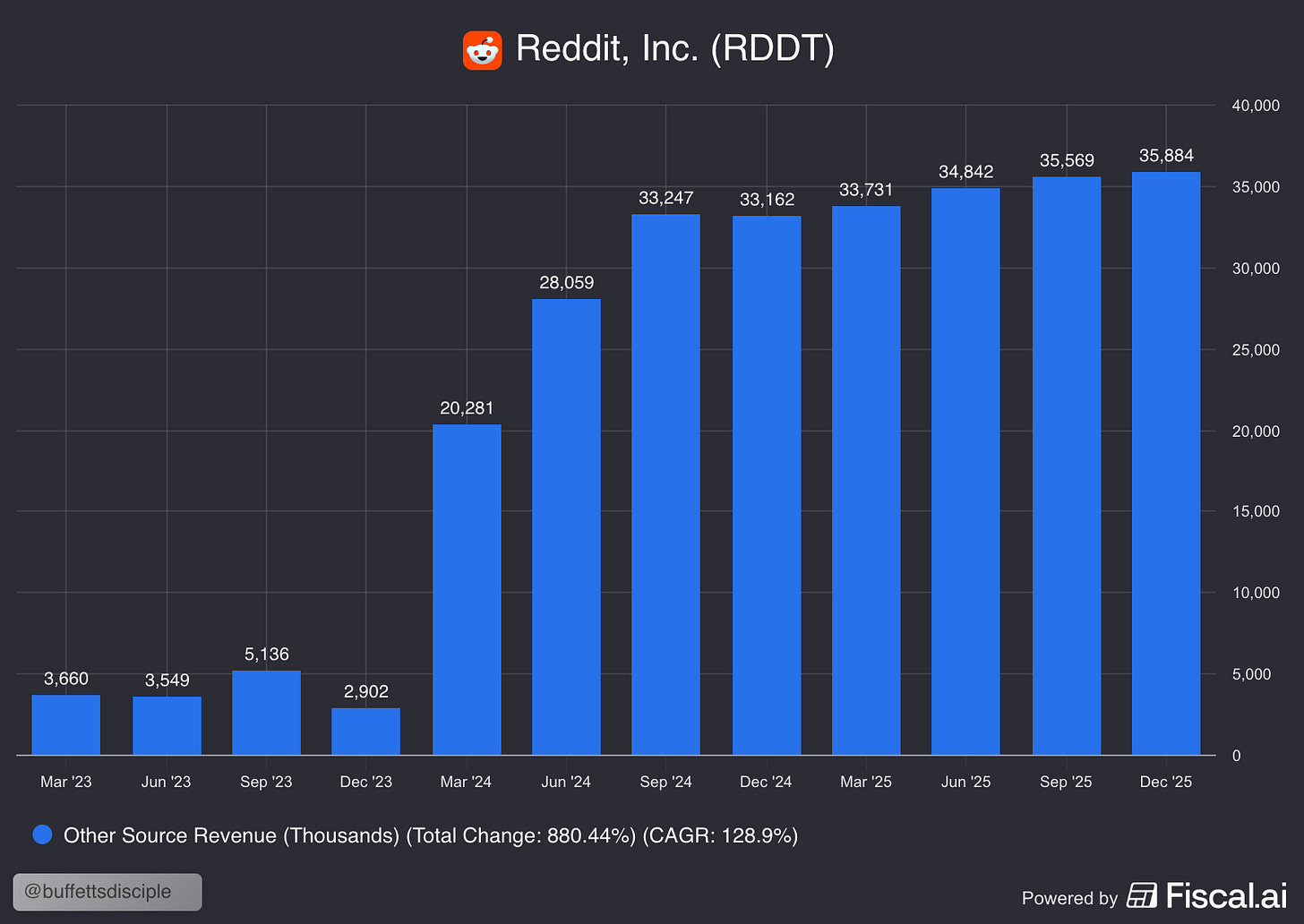

Data Licensing

Reddit operates a data licensing business that provides access to its data to various AI models, notably Gemini and OpenAI. This business has been stagnant since the end of 2024, and I expect this to continue. It’s still a very high-margin business, and it’s largely the reason Reddit became profitable in Q3 24, even though they had projected to take a bit longer. They currently have a lawsuit with Anthropic, as Anthropic has been scraping Reddit’s data without paying for it. If Anthropic were to commit to licensing the data, we could see a modest bump in data licensing revenues. Beyond that, though, I would not expect this business to grow meaningfully.

Reddit always underguides

Reddit consistently sandbags its guidance, and I expect that to be the case in Q1. Management indicated a 54% upper bound for Q1 growth. If we use historical outperformance as an indicator, we can estimate that the real Q1 numbers will be closer to $628m or 60% YoY growth. I don’t have a crystal ball for how the year will play out, but if we start at 60% year-over-year growth, it’s not hard to imagine Reddit growing 50% for the year. Notably, Meta is guiding to 30% growth in Q1. I think AI is showing real, tangible results in the advertising business, and the ceiling for these companies is very high.

Competition/Moat

Reddit is unique within the social media landscape in that it has inverted the model. For most social media, you follow an individual. However, on Reddit, the individual is anonymous, and instead, you follow a community. This is a distinctive value proposition, which is why Reddit provides a unique experience relative to its competitors.

Being first to market with this novel model has enabled Reddit to build a community, thereby creating an embedded network effect. To compete effectively, you need to build a community of the same size and diversity, which is highly difficult given that Reddit already exists. The rise of AI and vibe coding is irrelevant for a product like Reddit. Reddit is among the easiest products to replicate. There are many tutorials on YouTube on how to build Reddit from scratch. Someone with limited coding knowledge could have built a competitor in a week. Reddit’s moat was never in building a product itself. It’s always been in the community itself. You must duplicate the community to compete.

I think, given Reddit’s unique value proposition, they’ll be fine in the overall competition for users’ attention. I have no fear of competition, as Reddit has long competed with other social media platforms. There’s room for multiple players in the attention economy.

Leadership

I prefer to see a slightly higher approval rating from a CEO, typically 80% or more. However, given the exceptional results, I don’t read too much into Steve Huffman’s lower approval rating. I’m also content with a Glassdoor rating of 3.8 above. It indicates that they treat their employees relatively well and that employees enjoy working on their product. I have observed a strong correlation between poor Glassdoor ratings and underperformance. See PayPal, Fiserv, and Hims for reference.

Buybacks and balance sheet

Reddit has a fortress balance sheet boasting over $2B in cash. In Q4, they announced a $1B buyback with the aim of maintaining a $1B cash balance at all times. The move to buybacks is significant, as it further accelerates the business’s ability to grow earnings. As I’ve argued, business multiples are closer to the mid-20s today, implying they can reduce shares outstanding by 3% annually. The threshold for achieving 20% growth is extremely low. They need to achieve 17% organic growth through user and ARPU growth, plus 3% inorganic growth through buybacks. I am of the opinion that they will comfortably clear these numbers over the next five years at a minimum.

The Main Bear Case

The primary concern regarding Reddit is its daily active user (DAU) growth. For a business like Reddit, growth typically occurs in three core ways: DAU growth, time spent per DAU, and higher advertising spend (better ROI for advertisers). If your users stop growing, it becomes harder to grow your revenue. Eventually, you’ll maximize the efficiency of your advertisements as well as the time spent on the platform by users. Whenever Reddit experiences a sell-off, it is always related to daily active users. In early 2025, when the stock collapsed from $200 to $100, it was because daily active user growth in the United States had begun to slow. Let’s examine this further

DAU Growth

United States domestic daily active user growth has stalled, with a 10% year-over-year increase in Q4 2025. The future growth of DAU is largely coming from international markets. Reddit has experienced strong growth in the international markets since it began translating its website using AI. The question now is whether this opens a pathway to long-term, sustainable growth or yields only short-term gains through the site's translation. It’s crucial to continue customizing the home feed to better accommodate users from diverse backgrounds. Investors are concerned because the number of logged-in users has increased by only 10% year over year. With that said, Reddit is so cheap that the margin for error is quite high. I cannot provide guidance on daily active user growth, as I do not have sufficient information. However, as long as they continue to improve their product, they should be able to sustain 10% annual user growth for the foreseeable future.

Reddit is very political

Another pain point for me with Reddit is how political the website is. It has manifested in every subreddit, even in ones that have nothing to do with politics, such as r/stocks. The only reason I bring this up is that it turns off users from using the site on two fronts:

If someone is moderate/conservative, it is not appealing

If you want peace and quiet from politics, it is also not appealing

Reddit recently hired a new Chief Product Officer, Maria Angelidou-Smith, and I’m hopeful she’ll take the site in a positive direction by curating content more closely to specific users’ tastes. There’s significant low-hanging fruit here, and it’s the best way to continue to grow DAU in my view.

“Price to Sales”

Whenever Reddit is mentioned, people tend to note that its price-to-sales ratio is high. Reddit has a high P/S because its margins are high. Investors are not valuing the business on its sales. They’re valuing it on its earnings. I couldn't care less what their price-to-sales multiple is.

“something something AI”

AI is more of a tailwind than a bear case, but I don’t doubt this will come up. If you feel strongly about it, feel free to short the company.

Valuation

I expect they will achieve 40% margins by Q3 of this year. As a result, I prefer to annualize my estimate of their Q4 2026 earnings.

The bear case implies just 16% upside with earnings multiple compression. This would likely occur if the overall markets saw weakness. If Reddit maintains its current multiples and delivers 50% growth with some margin expansion, it would not surprise me to see the stock re-rate to roughly $220. If they outperform growth yet again and experience multiple expansions, we could see as high as $280, although I find this scenario unlikely.

The company is very cheap here. As long as it can maintain decent growth rates with buybacks and continued margin expansion, it will be incredibly difficult to lose money as a long-term holder. I think another year of growth will put a lot of the doubts to bed.

My Reddit Position

Reddit is an extremely volatile company. When you open a position, you should be aware of that ahead of time. If it dropped another 20-30%, I wouldn’t be surprised at all. If this occurs, I will be loading aggressively. I was long 275 shares at $100/share early last year and took profits when it went past $240, as I felt it was trading 20% above intrinsic value. I allocated those profits to what I consider opportunities with multi-bagger upside. This recent sell-off has allowed me to reopen my position. I initiated a small position of 75 shares using the available cash I have. I’d feel very comfortable building this to 10% sizing. I’d need Reddit to drop another 20-30% before I’d be willing to sell other positions, though, so for now it will stay small.

Conclusion

Reddit is more profitable than it appears at first glance, with aggressive revenue growth, margin expansion, and operational efficiencies enabled by AI. This will result in Reddit’s earnings multiple compressing rapidly if the stock stays flat. When the market comes to understand both the growth and margin story, the stock will re-rate even if the multiple does not expand. Based on its guidance from Q1 results, Reddit is on track to deliver 50% growth this year. Even if the business were to have multiple compressions and grow 40%, it would still deliver upside from here.

https://www.reuters.com/markets/deals/reddit-prices-ipo-top-indicated-range-sources-say-2024-03-20/

https://www.macrotrends.net/stocks/charts/META/meta-platforms/number-of-employees?utm_source=chatgpt.com

AI can flood social media with shit! So its not really clear that social media is a winner

Nice write up! I wondered how Reddit made money. Also interesting to see an insider recently bought 7 million USD worth of shares between $139-$149 price per share