Gold Miners: Still Cheap

Understanding gold today, the future of gold and a number of gold miners that are cheap today

Disclaimer

This is not financial advice; do your own research.

TLDR: If gold stays at these prices, almost all gold miners are very cheap.

A number of gold miners are still trading at cheap multiples, even after this historic gold run. This is primarily because gold miners' earnings increase faster than the price of gold, since their costs are fixed. A 50% increase in the price of gold can easily result in a 100% increase in earnings. Given that most gold producers sold gold at $3,300 per ounce in Q3, and gold is now at $5,000 per ounce, it stands to reason that gold miners will have another good year. The math: Gold producers are going to absolutely print.

That is, of course, if gold prices stay at their current levels. Commodities are notoriously cyclical, and gold is no exception. However, I firmly believe gold prices will be higher for longer, and the reason is condensed in the following sentence.

The price of gold is a function of perceived risk in the world.

The last five years we’ve had pandemics, wars, inflation, burgeoning debt, tariffs, massive geopolitical tensions, supply chain constraints, social unrest, etc. As a millennial, this is unquestionably the most uncertain world I’ve lived in in my lifetime. To best understand this, let’s break down the core issues driving the price of gold.

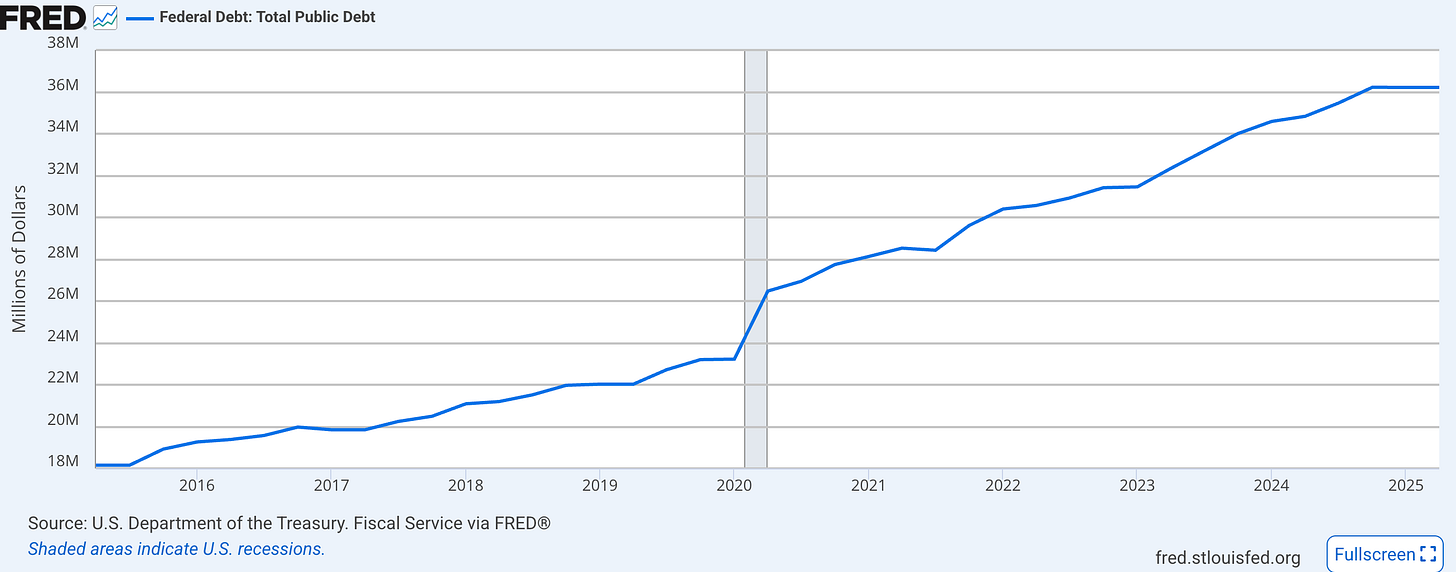

US Debt/Deficit

Since COVID, we have seen a noticeable increase in total U.S. debt. Under both Democrats and Republicans, there’s been little push to actually address the debt problem. The primary reason for this is that fixing the U.S. debt would be political suicide. The biggest pain point in U.S. spending is also its three most crucial social programs: Social Security, Medicare, and Medicaid. These 3 programs alone make up 45% of the U.S. annual spend. How to fix them? Increase taxes, as well as the age at which you can access Medicare and Social Security. No president or congressmember will be re-elected with tax increases and delaying social benefits, especially given that old people are the primary voters. Congress won’t address the issue until the American people are ready to bear the pain of higher taxes and reduced benefits. I believe the burgeoning U.S. debt is one of the primary drivers behind gold prices. If the US dollar cannot be counted on as the world reserve currency, what can? Primarily gold.

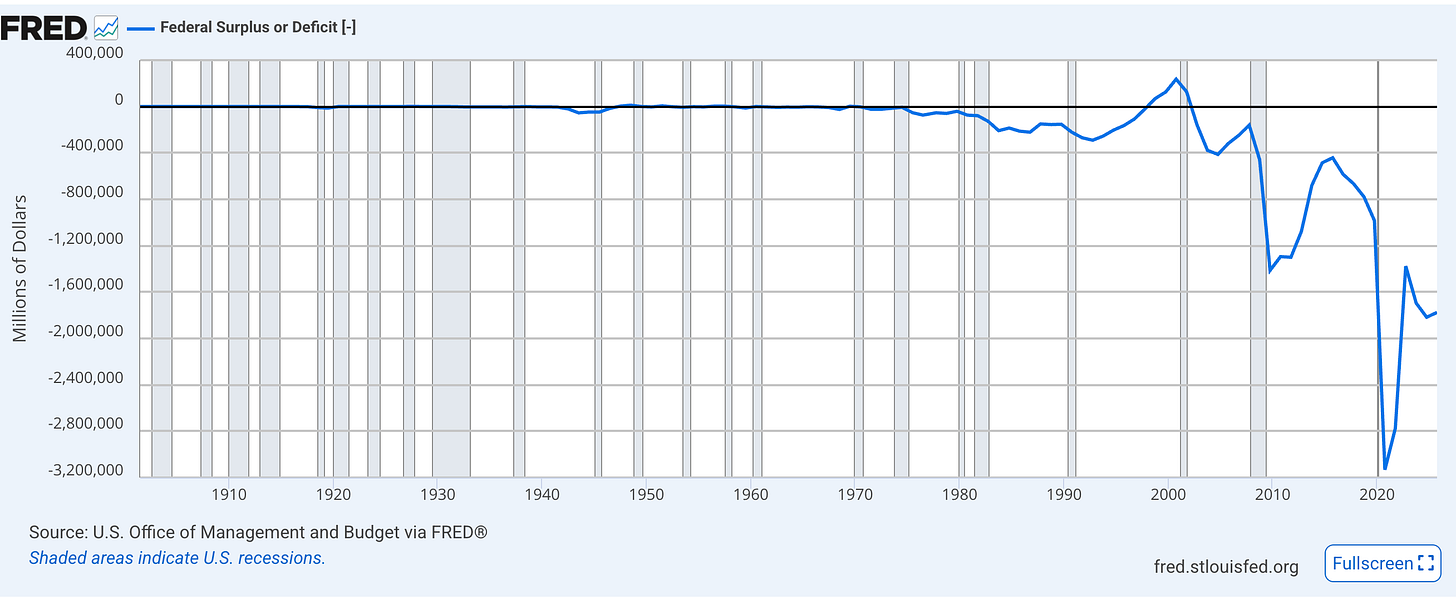

The United States went from a hundred years of fiscal responsibility, except during times of need (WWII), to regularly overspending. The United States currently spends over a trillion dollars in interest alone per annum. Current projections indicate the budget deficit will reach $2.5 trillion annually by 2035. The deficit is clearly trending worse over the last 20 years, and all indications are that this trend will continue.

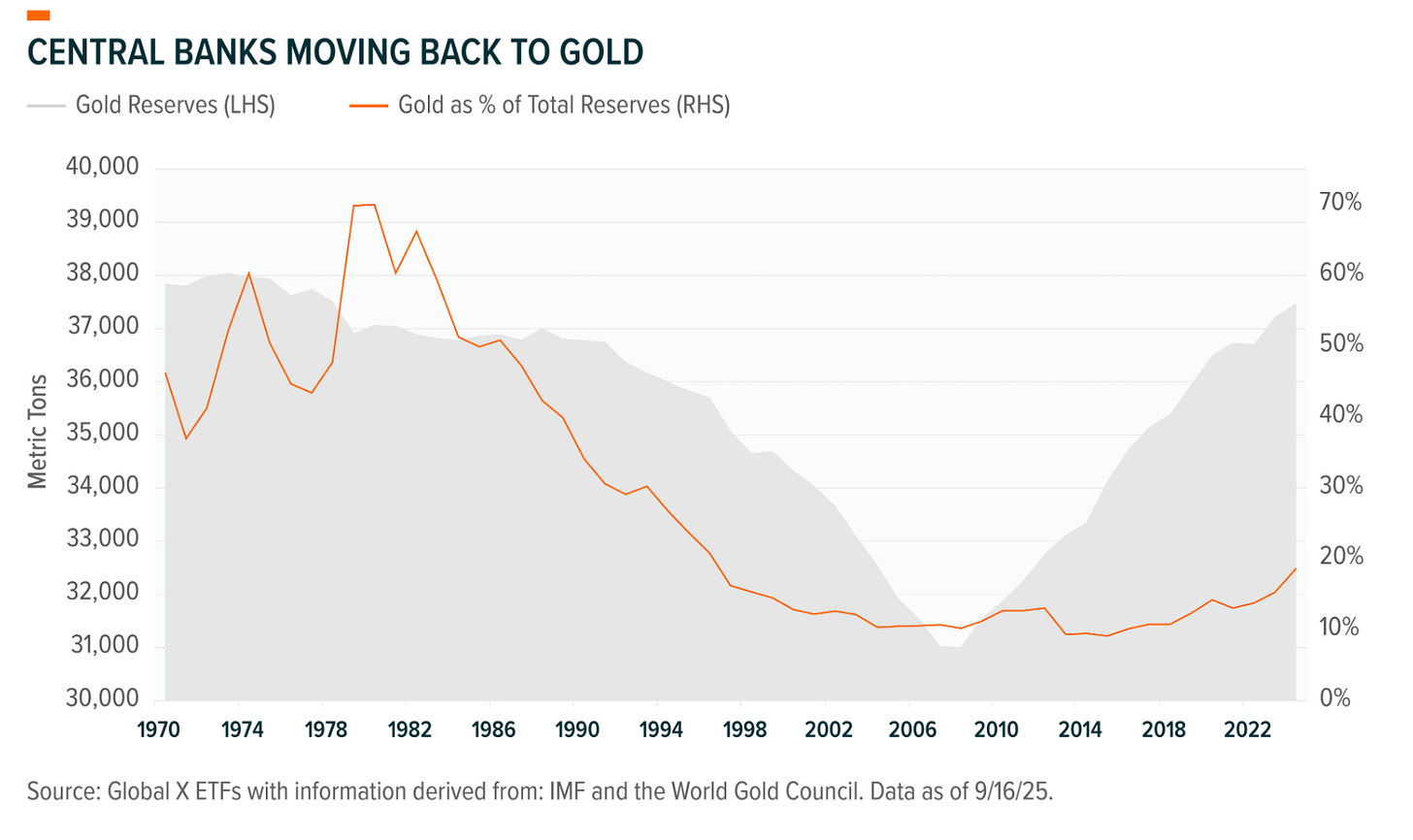

Russia’s invasion of Ukraine

At the beginning of 2022, Russia invaded Ukraine, launching the largest land war in Europe in decades. In response, the United States froze $300B of the Russian Central Bank’s foreign reserves. Historically, the United States has never weaponized its status as a world reserve currency. This forced countries to rethink their reserve strategies. If you can’t use the US dollar, what can you use? The natural response was to acquire precious metals, specifically gold. China’s gold acquisition accelerated sharply after U.S. sanctions on Russia. Numerous other countries loosely allied with the non-Western world soon followed.

The United States moved from a gold-backed system to fiat in the early 1970s. I suspect the massive reduction in gold reserves coincided with a majority of the world implementing a similar system. The massive drop-off also coincided with a period of relative peace and prosperity. I would expect central banks to continue building their reserves for the foreseeable future, potentially reaching levels last seen in the past. This is especially true for countries that are not allied with the United States and do not trust it.

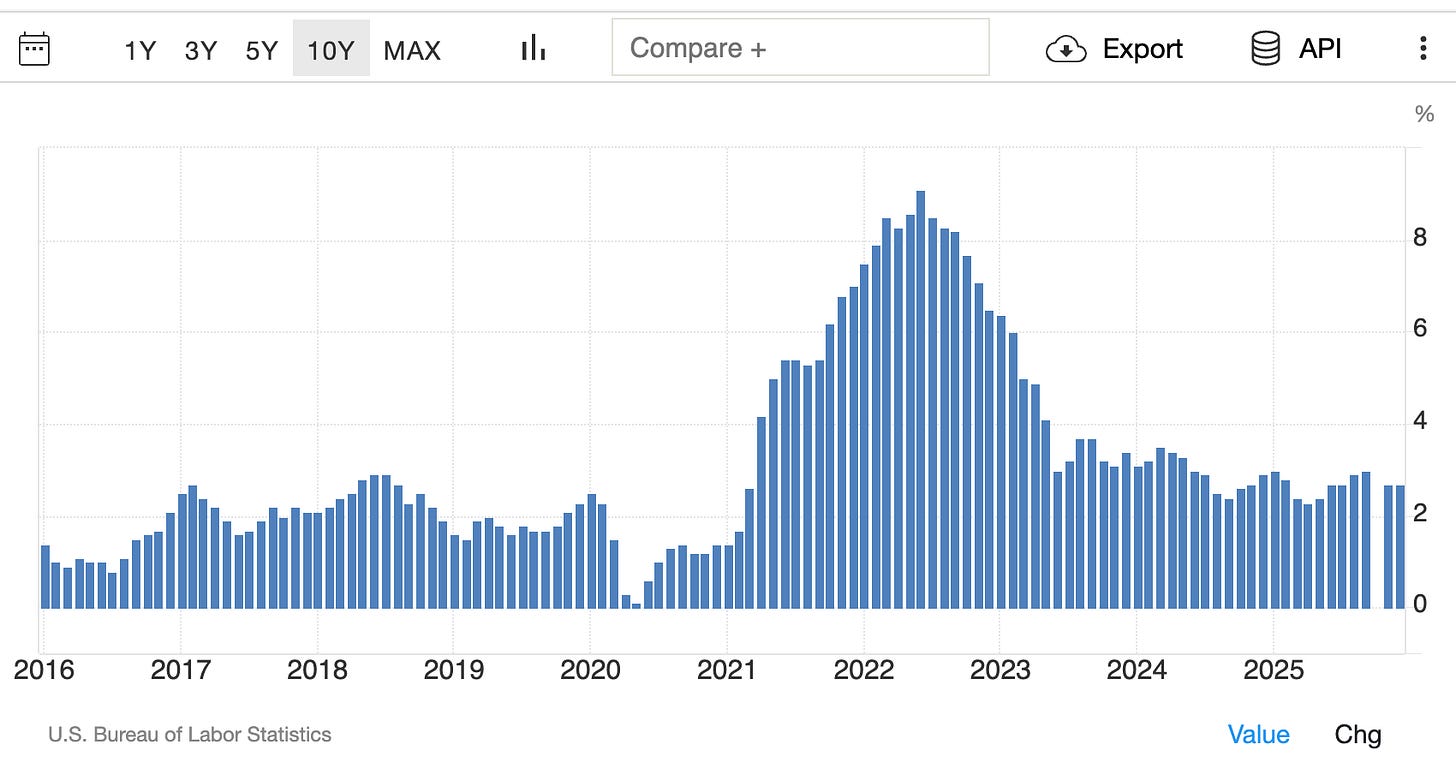

Inflation

In response to COVID, the United States aggressively printed money amid fears of a significant economic collapse. While perhaps prudent at the beginning of the pandemic, this policy significantly increased the money supply and, as a result, caused significant inflation, peaking at over 8% in 2022. In response, the Fed aggressively raised rates, peaking at 5.5%, before bringing inflation under control. Despite inflation coming down aggressively, it still notably lags its historic 2% rate in recent years and has been stubbornly stuck at 3%. At 3% inflation, the cost of goods will double every 23.5 years. A significant difference compared to 2%, where the cost of goods doubles every 35 years. Inflation being 50% higher than the historic average adds up, and I personally believe these higher inflation levels are here to stay. Not only is our money less valuable than it was just a few years ago, but the value is depreciating faster than ever.

Supply of Gold

Gold production today is close to historic highs. Still, it’s been relatively constant at 3,500 tonnes annually1 for several years now. With demand at 5k+ tonnes annually2, it’s not nearly enough to meet current net demand. The supply side cannot be easily fixed either. The time to bring a new mine online is at least a decade, making supply relatively inelastic. Mines are also not easily able to increase output as mining infrastructure is inherently capacity-constrained. Increasing output requires significant capital expenditure, something that is largely not worth it for most miners. In conclusion, we cannot expect supply to increase meaningfully.

So, why do I like gold miners at these levels?

The rise in gold prices is driving a massive surge in free cash flow for gold miners. Gold miners now have a financial buffer in downturns, implying profitability at all points in the cycle. This makes them fundamentally better businesses. Every business is priced relative to its economics.

The surge in free cash flow is also driving record cash on the balance sheet, providing significant optionality for dividends, share repurchases, and M&A. A number of mines are clearing off their debts. They now have investment optionality that they did not have until recently. I believe the M&A part is particularly interesting, especially for investors looking to invest in junior miners seeking an easy exit. The more miners that have money, the more miners will be active in acquisition, driving up multiples for Junior miners.

Better balance sheets, better economics, and a powerful hedge that is immune to the fiscal concerns of today. I believe we’ll see increased demand for gold miners, and these businesses will see higher multiples than they have historically

Most gold miners are trading at mid-single-digit FCF based on Q1 numbers annualized. If gold stays at these price levels, most of these companies will be multi-baggers.

The Bear Case

Gold miners are obviously dependent on gold's price. If my read is incorrect and the price of gold were to retreat back below $3,500, a number of these producers would likely be re-rated downwards. Commodity downtrends can be aggressive, so miners’ moves can be too. just something to be aware of when building, sizing, and investing a position

Miners that are cheap here

Note: All numbers have been normalized to USD for simplicity, except for stock prices. Those are all CA$, since they are all mostly listed on the TSX.

My personal holdings are $TXG.TO, $SBI.TO and $ALTN.L.

LATAM

LATAM governments have a history of trying to nationalize mining. There has been limited success in doing so, and these days it’s primarily rhetoric. However, it is priced into the market multiples. These fears are overblown, and I believe most LATAM miners are due for a re-rating.

Torex Gold

Ticker: TXG.TO

Market Cap: $5.3B

Price: CA$80.01

12-month Target: CA$120

Gold Production: 400k AuEq per annum

AISC: $1,600

Forward FCF: sub 8x

Torex is one of my favorite gold producers on the list for several reasons. First and foremost, I like their CEO (Jody Kuzenko), and I think she is incredibly competent when it comes to capital allocation. Torex recently acquired Prime Mining for $327 million, increasing its indicated reserves by over 30% (+1.5 Moz Au and +54 Moz Ag). Essentially, they bought over $10B+ worth of deposits for pennies on the dollar. The primary reason they were able to access this mine at such a low price is that it was struggling to operate in Mexico due to the cartel. While that might typically be a concern, Torex has been operating in the region for over a decade. I have absolute confidence in them to restart this mine. Even if they don’t, the business is still cheap here.

In addition, Torex is a multi-ore producer, producing significant amounts of silver and copper alongside its core gold production. This diversifies their income stream, and typically diversified producers earn higher multiples. The last thing I like about Torex is the recent ramp-up of its Media Luna, its new mine. They connected Media Luna to their existing mine, El Limón Guajes. This means they can use the same infrastructure for processing the gold. The Media Luna property, also known as the Morelos property, is mostly unexplored, with 75% of it yet to be drilled. When they start drilling it, they will likely see a significant increase in their reserves.

Finally, Torex acquired Reyna Silver for $27m, which included numerous early-stage silver mines. With silver price hitting $100, it’ll be interesting to see how these mines develop and could be a further long-term tailwind for the company. Torex is building off an incredible base with a bright future. It’s why I believe it is the safest bet among the companies mentioned in this article.

Serabi Gold

Ticker: SBI.TO

Market Cap: $355m

Price: CA$6.68

12-month Target: CA$12

Gold Production: 45k oz per annum

AISC: $1,600

Forward FCF: 5x

Serabi Gold is a gold producer in Brazil operating two different mining complexes. The primary one of note is the Coringa complex. Coringa is situated near indigenous lands and, as a result, was granted a 3-year temporary license at the beginning of 2024, which expires in early 2027. Historically, miners in the area had been reckless in their operations, causing significant damage to the local area and environment. The renewal contingency is based on Serabi's ability to operate the mine in accordance with the country's laws and regulations. I think it’s incredibly likely they receive a renewal, but that is not how the stock is being priced in the market.

In addition, Coringa has not been significantly drilled, and given that Serabi has been cash-strapped until recently, it’s only now that they have the opportunity to aggressively drill the property for additional veins. They’ve been pretty consistent in their ramp-up of production. And they have aspirations to grow reserves to 1.5 million ounces and production to 100,000 ounces. I think there is room for significant re-rating in the next year on the license renewal alone. If they can continue to grow reserves and production, it would imply multi-bagger upside. I believe this is at least a double, but could be as high as a 4X by early 2028.

Jaguar Mining Inc

Ticker: JAG.TO

Market Cap: $500m

Price: CA$9.08

12-month Target: CA$18

Gold Production: 40k oz per annum

P/E: negative

AISC: $1,840

Forward FCF: 4x

They operate three mines in Brazil. Due to non-compliance, Jaguar temporarily shut down its Turmalina mine. This cut their production by about 15-20k ounces per annum. Santa Isabel, their third mine, only came online recently and is expected to contribute at least 5koz+ annually. Their 2026 run rate will be 70koz+. Essentially, the mine will see a 50%+ increase in production, along with $5,000/oz gold prices; they’re trading at a forward earnings multiple of roughly 4. The valuation is quite compelling. That is, if they execute, and the fact that they had a mine shutdown for non-compliance is a concern.

African Gold Miners

I’m including African gold miners in this list because they’re incredibly cheap. The reason these assets are cheap is the high level of instability in Africa and the tendency of African governments to nationalize mining. I personally do not feel I have a good grasp on African geopolitics or the governments of any of these nations. As a result, I’m sitting this one out. That being said, if more certainty comes into any of these miners, they’d have the potential to re-rate quite significantly. I think a basket approach here could be interesting. The other thing I’d point out is that gold’s economics in Africa are the same as in Canada. Depending on where gold prices go, these businesses could end up absurdly cheap.

Perseus Mining

Ticker: PRU.TO

Market Cap: $5.4B

Price: CA$6.04

12-month Target: CA$9

Gold Production: 500k oz per annum

AISC: $1,230

P/E: 15

Forward FCF: sub 6x

Perseus Mining has a diversified portfolio across Africa, including Ghana, Guinea, Sudan, Mali, and Tanzania. This diversification helps insulate the business from some of the geopolitical risks it faces from time to time. What’s also interesting is their fortress balance sheet, which contains almost $800 million in cash and bullion. The business is cheap relative to its production, given its enterprise value. Perseus is an Australian company, so they report twice a year. The last price they reported was $2,500 an ounce. This implies earnings and cash flow will comfortably double in 2026. I think the diversified portfolio, strong balance sheet, and long history of successful operations make it a solid opportunity within Africa.

Thor Explorations Ltd.

Ticker: THX.V

Market Cap: $700M

Price: CA$1.71

12-month Target: CA$3.50

Gold Production: 90k oz per annum

AISC: $1,000

P/E: 4.35

Forward FCF: sub 3x

Thor Explorations is unquestionably the cheapest mine of any company we’ll talk about today. They currently hold a stockpile of 44,000 ounces of unprocessed gold, implying approximately $200m today, and an additional $80m in cash on the balance sheet. The company trades at sub-3X earnings relative to enterprise value, and a forward multiple of 2x or lower on an EV basis. Their discount is due to having only one active mine, a Nigerian mine, with remaining reserves of 500k ounces. Management has indicated that production will decline to 75k ounces next year, and all-in costs will bump up to $1,200. Production is set to continue declining, and that is already priced in. The question then becomes if they can develop these new mines, and given the long time it takes to bring mines online, it could be a while. Still, I think it could be an interesting trade over the next couple of quarters.

Their plan is to invest their additional cash into new properties that they have acquired in both Senegal and the Ivory Coast. It’s unclear exactly what the transition of the current mine to these new ones would look like or how long that would take. I think the biggest risk with Thor is if management is wasteful with the cash they generate. If the new mines are not feasible, it’s possible they will continue trying to invest in new business opportunities, which could destroy shareholder value if unsuccessful. Otherwise, the company will effectively trade at its book value within a couple of years.

Orezone Gold Corporation

Ticker: ORE.TO

Market Cap: $1B

Price: CA$2.40

12-month Target: CA$4.80

Gold Production: 110k oz per annum

AISC: $1,958

P/E: 15

Forward FCF: sub 5x

Orezone Gold Corporation operates primarily in Burkina Faso. Since the majority of my readers, I assume, are not familiar with West Africa, Burkina Faso is an incredibly dangerous country that recently underwent a coup d’état. The current president, Ibrahim Traoré, is looking to increase control over mining, and it’s possible this will result in increased taxes or royalties paid to the government, which could be a fairly sizable headwind to Orezone. Given that 80% of the country’s export is gold3, it seems likely to me that these royalties will increase over the years. The company is set to increase production by approximately 50% this year due to its Stage 1 hard rock expansion, bringing production to 155k+ oz annually. This would comfortably double revenues and, as a result, easily increase earnings by more than 100%. The company is set for further expansion over the next couple of years.

Orezone has a stage 2 to the hard rock expansion. This would increase their production up to 220k oz annually, double from today’s production. There is no timeline for this, as their primary focus has been on completing and starting Stage 1. Management has also mentioned that they’re waiting for the outcome of the negotiations between West African Resources and the Government regarding taking a stake in the company. If gold prices were to stay here and they complete Stage 2, it seems to me there would be multi-bagger upside in this stock. The math implies at least a 4x increase if the government doesn’t further increase gold royalties.

Asian Gold Miner

I looked through a number of Asian gold miners, and Altyn is the only one I like. Its current valuation is compelling.

Altyngold PLC

Ticker: ALTN.L

Market Cap: $615m

Price: GBX1,635.82

12-month Target: GBX3,200

Gold Production: 50k oz per annum

AISC: $1,357/oz

P/E: 14

Forward FCF: sub 5x

Altyn is a Kazakh gold miner trading at cheap multiples. The thing about Kazakhstan is that it borders both Russia and China. Definitely an interesting geopolitical position to be in right now. Kazakhstan isn’t really a true democracy either. I’m not sure how to describe the government other than reasonably sensible, but authoritarian. Kazakhstan is a mining-friendly country, and it’s also absolutely massive. I wouldn’t be surprised if this business used its free cash flows to invest in other mines at some point. Compared to some of the other plays, I actually think this is one of the safest geopolitically and politically, ironically. The Kazakh government is pro-mining, and Russia/China tend to leave Kazakhstan to its own devices. The company just reported Q4 earnings on January 22nd. Going off those numbers, they’re trading at approximately 4-5x annualized earnings. They also realized a price per ounce of $4,000, meaning their earnings would increase throughout the year beyond Q4. The company aims to reach 100,000 ounces of annual production over the next few years, unlocking even more upside. I think Altyngold has 2-4x potential here.

Conclusion

Given the geopolitical risks these miners face, I believe a basket approach is prudent. If you prefer concentration, I like $TXG.TO the most. If you’re looking for upside with perhaps high volatility, my personal preference is Altyn and Serabi. There’s undoubtedly significantly more cheap miners that are overlooked by the market because of their geographic location. I think these valuation disconnects will likely close by early 2027. In my opinion, the market still doesn’t fully believe the gold story, and it’s why valuation disconnects still exist in numerous miners. The longer that gold stays at these prices, the more likely gold miners are to see a proper re-rating to match their intrinsic value.

https://aheadoftheherd.com/our-gold-mining-industry-is-in-trouble-richard-mills

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2024

https://oec.world/en/profile/country/bfa